The Best Medicare Plans in Charleston County: A Coastal Guide to Coverage in 2025

Navigating Medicare in Charleston County

If you live in Charleston County, South Carolina, and you’re turning 65—or already have Medicare—you may be wondering about your options for 2025.

With so many choices, plans, and insurance companies, it’s easy to feel overwhelmed.

But don’t worry—you’re not alone.

What Is Medicare and Why Does It Matter?

Medicare is health insurance for people 65 and older and some younger people with disabilities.

It helps cover hospital visits, doctor appointments, prescriptions, and more.

Without Medicare, many seniors would have to pay high costs for healthcare out of their own pockets.

Making the correct choice matters because:

- You want to keep your favorite doctor.

- You may need coverage for special medications or hospital stays.

- Some plans offer extra benefits, like dental, vision, or hearing.

Why Charleston County Is Unique

Charleston County is home to a mix of rural and city areas, with well-known places like Charleston, Mount Pleasant, North Charleston, James Island, Johns Island, and Folly Beach.

Seniors here have access to some of the best hospitals in the state, including:

- MUSC Health University Medical Center

- Roper Hospital

- East Cooper Medical Center

- Trident Medical Center

Because there are so many different doctors, clinics, and Medicare plans in this area, it is essential to choose a plan that works with your local providers.

Don’t Get Lost in the Confusion—Palmetto Mutual Can Help

Many seniors try to figure it all out using websites like Medicare.gov.

While it can be a helpful tool for some, it can also be confusing and complicated, especially if you’re unsure which plan best suits your needs.

That’s where Palmetto Mutual comes in.

We’re a local South Carolina agency that’s helped thousands of seniors across Charleston County and beyond.

We’ll sit down with you, answer your questions, and help you choose a Medicare plan that:

- Fits your budget

- Covers your doctors and prescriptions

- Offers benefits you can use

And best of all, getting help from Palmetto Mutual is entirely free.

Understanding Medicare: Parts A, B, C, and D

Medicare is like a big puzzle made up of four main pieces.

Knowing what each part does can help you choose the right coverage, without feeling lost.

Part A – Hospital Insurance

Part A helps pay for care you get in a hospital.

It also helps cover:

- Skilled nursing facilities (like rehab after a hospital stay)

- Hospice care

- Some home health care

✅ Example: If you have surgery at MUSC in Charleston, Part A helps cover your hospital stay and recovery time.

Part B – Medical Insurance

Part B helps pay for things like:

- Doctor visits

- Lab work and tests

- Preventive care (like flu shots)

- Outpatient services

✅ Example: If you see a heart doctor in Mount Pleasant or get an X-ray at Roper St. Francis, that’s covered under Part B.

💡 Tip: Most people pay a monthly premium for Part B.

In 2025, the standard premium is expected to be slightly higher than last year—but we’ll help you understand exactly what you’ll pay.

Part C – Medicare Advantage Plans

Part C (also called Medicare Advantage) is a different way to get your Medicare.

These plans come from private insurance companies and combine Part A and B, and many include Part D (prescription coverage).

Some even give you:

- Dental

- Vision

- Hearing

- Over-the-counter cards or healthy food benefits

✅ Example: If you have a Medicare Advantage plan from Humana or Aetna and live in North Charleston, you might get a card that helps pay for groceries or vitamins.

But be careful—these plans have networks, so your doctor has to be in their system.

Part D – Prescription Drug Coverage

Part D helps pay for medicines.

It can be a standalone plan or bundled with a Medicare Advantage plan.

Each plan has its list of covered drugs (called a formulary).

✅ Example: If you take blood pressure or diabetes medicine and pick it up at a CVS in West Ashley, Part D helps lower the cost.

What’s New?

- Lower out-of-pocket drug costs: Medicare limits how much you’ll pay for prescriptions.

- Insulin costs stay low: $35 monthly limit continues.

- Extra help for low-income seniors is easier to qualify for.

These changes are significant, but they also complicate choosing a plan.

Medicare Advantage Plans in Charleston County

A Medicare Advantage plan might be right if you want more than just the basics from Medicare.

These plans are also called Part C.

They include everything in Part A (hospital) and Part B (doctor visits)—plus many give you extra benefits like:

- Prescription drug coverage

- Dental, vision, and hearing care

- Over-the-counter allowances or grocery cards

- Fitness memberships or transportation to the doctor

What’s Available?

In Charleston County, seniors can choose from many Medicare Advantage plans.

These plans are offered by private insurance companies that work with Medicare.

Depending on your desired benefits, some plans have $0 premiums, while others cost a little more each month.

Here are some of the top insurance companies offering Medicare Advantage plans in Charleston County:

- ✅ Sierra Health and Life Insurance Company, Inc.

- ✅ Humana Insurance Company – popular for $0 premium options and grocery cards

- ✅ Care Improvement Plus South Central Insurance Co.

- ✅ Arcadian Health Plan, Inc. – often has strong provider networks in the Lowcountry

- ✅ Aetna Life Insurance Company – known for excellent customer service and extra perks

🏥 Example: A Medicare Advantage plan from Humana might let you see a doctor at Trident Medical Center and also give you a $50 monthly allowance to buy healthy food at Walmart or CVS.

📊 Example Comparison: Grocery & OTC Cards in Charleston County

Here’s what real Medicare Advantage plans in the Charleston area may offer:

| Plan | Monthly Amount | Covers |

|---|---|---|

| Plan A | $25 | OTC items only |

| Plan B | $100 | Groceries + OTC combined |

| Plan C | $275 | Groceries + OTC + utilities |

💡 Note: Not all plans include all benefits. That’s why it helps to sit down with a local expert who knows what’s offered in your ZIP code.

How Much Do These Plans Cost?

Most plans in Charleston County offer:

- $0 or low monthly premiums

- Copays (a small fee when you visit the doctor or hospital)

- Annual out-of-pocket maximums to protect you from big medical bills

💡 Tip: Even if a plan has a $0 premium, it doesn’t mean it’s free.

You’ll still pay your Part B premium and service copays or costs.

Plan Ratings (Star Ratings)

Medicare gives each plan a rating of 1 to 5 (5 is the best).

This helps you see how good the plan is at:

- Customer service

- Helping members stay healthy

- Covering prescription drugs

Many plans in Charleston County are rated 3.5 to 4 stars, so they do a good job overall.

But ratings don’t tell the whole story.

A plan with high stars might not include your doctor or cover your prescriptions.

Medicare Supplement (Medigap) Plans in Charleston County

Not everyone wants a Medicare Advantage plan.

Some seniors prefer to keep their Original Medicare (Parts A and B) and add a Medicare Supplement plan called Medigap.

If you want the freedom to see any doctor who takes Medicare, and you don’t want to deal with networks or referrals, Medigap might be the right fit for you.

What Is Medigap?

Medigap helps fill the “gaps” that Original Medicare doesn’t pay for—like:

- Deductibles

- Copays

- Coinsurance

- Hospital costs after extended stays

💡 Example: If you go to Roper Hospital in Charleston and stay for a few days, Medicare covers most of the cost—but not all. A Medigap plan can pay the rest, so you don’t get a hefty bill.

Why Seniors in Charleston County Choose Medigap

- You can see any doctor in South Carolina—or the country—that accepts Medicare.

- You don’t need a referral to see a specialist.

- Plans are standardized, so the benefits are the same no matter which company you choose.

That means Plan G is Plan G, whether from Mutual of Omaha, Aetna, or another company.

Which Plans Are Available in Charleston County?

The most popular Medigap plans in Charleston County are:

- Plan G – Great coverage, pays almost everything except the small Part B deductible

- Plan N – Lower monthly premium, but you may have copays for doctor visits and ER visits

- High-Deductible Plan G – Lower premium, but you pay more out of pocket before coverage kicks in

✅ Example: If you live in Mount Pleasant and want a plan to travel without worrying about networks, Plan G or Plan N could be perfect for you.

What Do Medigap Plans Cost?

Medigap plan premiums depend on:

- Your age

- Your gender

- Your zip code

- The insurance company you choose

In Charleston County, many 65-year-olds can get Plan G starting around $100–$130/month, depending on the company and your health.

However, prices can increase, so comparing options is necessary before enrolling.

Prescription Drug Coverage (Part D) in Charleston County

If you take any medications—even just one or two—Medicare Part D is something you don’t want to skip.

It’s what helps cover the cost of prescription drugs.

Even if you’re healthy now, having a Part D plan can protect you in the future.

And if you don’t sign up when you’re first eligible, you could pay a late enrollment penalty later.

Why Is Part D Important?

Prescription drugs can be expensive, especially without insurance. Part D helps cover:

- Brand-name and generic medications

- Drugs picked up at local pharmacies (like CVS, Walgreens, or Harris Teeter)

- Certain shots and vaccines (like shingles or flu shots)

✅ Example: If you live in James Island and take medication for high blood pressure or diabetes, Part D can help lower the cost of those prescriptions.

What Plans Are Available in Charleston County?

In 2025, many Part D plans will be available to Charleston County residents. These are offered by private companies, such as:

- Aetna

- Humana

- SilverScript (a CVS Health company)

- WellCare

- Cigna

Each plan has its own:

- Monthly premium

- Drug list (called a formulary)

- Preferred pharmacies

- Copays and coinsurance

Some plans have premiums as low as $0–$20/month, but be sure the plan covers the medications you need.

That’s where we come in.

What’s Changing in 2025?

There are a few significant improvements for 2025 that Charleston County seniors should know about:

- ✅ Out-of-pocket maximum: In 2025, there’s a new limit on how much you’ll pay for prescriptions during the year. This means once you reach that amount, you won’t pay anything more for covered drugs.

- ✅ Insulin stays affordable: Insulin will be capped at $35/month.

- ✅ More help for low-income seniors: It’s easier to qualify for Extra Help (also called the Low-Income Subsidy), which lowers drug costs even more.

These changes are significant, but they make choosing a plan more confusing.

Special Needs Plans (SNPs) in Charleston County

Not every Medicare plan is built the same.

Some plans are designed for people with specific health needs. These are called Special Needs Plans, or SNPs for short (pronounced “snips”).

If you have a specific health condition, live in a care facility, or qualify for both Medicare and Medicaid, you might be eligible for a plan made just for you.

What Is a Special Needs Plan?

A Special Needs Plan is a Medicare Advantage plan (Part C) built to support seniors needing extra help managing their care. These plans:

- Work with your doctors and specialists.

- Help manage medications.

- Offer benefits like dental, hearing, vision, and transportation.

- Often come with $0 premiums and $0 copays.

✅ Example: If you have diabetes and live in West Ashley, a Special Needs Plan might cover your insulin, doctor visits, and even trips to your appointments—all at little or no cost.

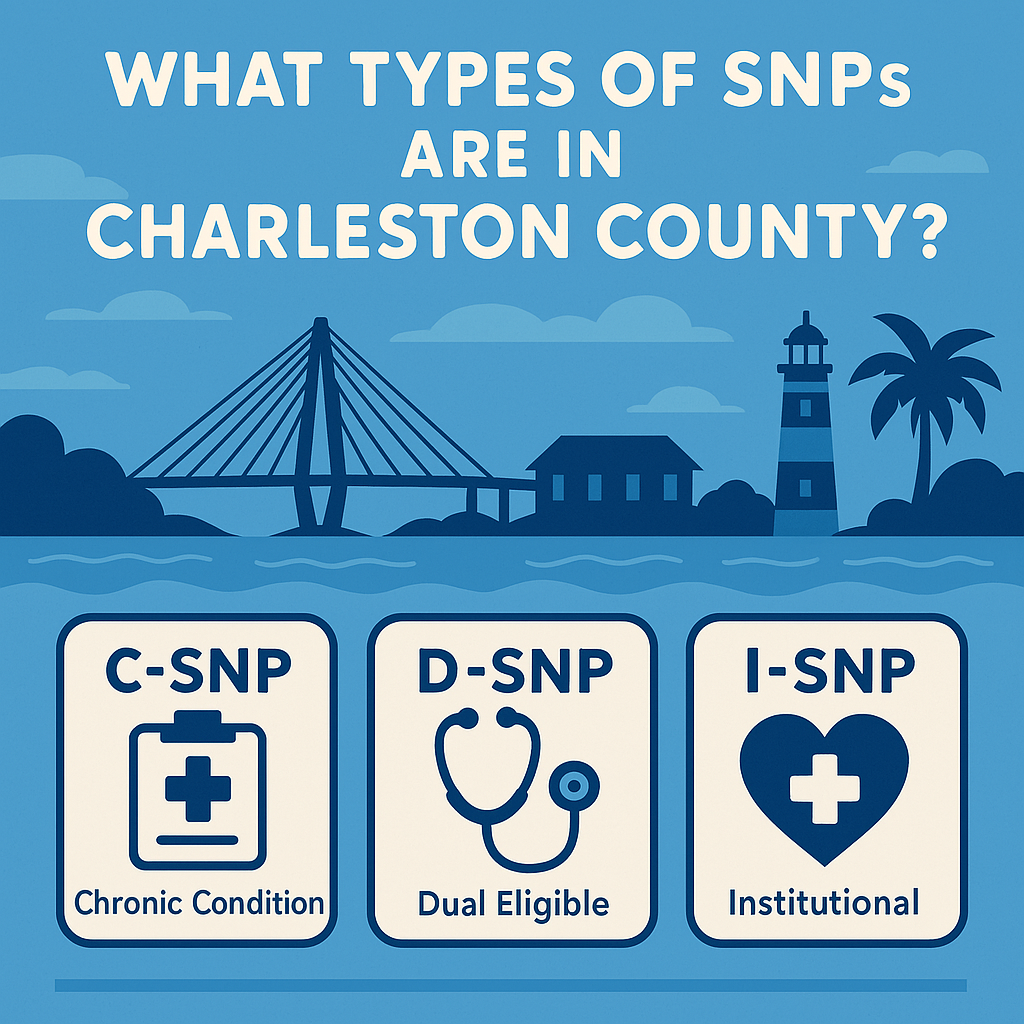

What Types of SNPs Are in Charleston County?

In Charleston County, seniors may qualify for the following types of SNPs:

1. Dual Eligible SNPs (D-SNP)

These are for people who have both Medicare and Medicaid.

- $0 premium plans with lots of extra benefits.

- Help coordinate care between Medicare and Medicaid.

- Often includes vision, dental, hearing, and over-the-counter benefits.

✅ Example: A senior in North Charleston who receives Medicaid and has Medicare might qualify for a D-SNP from Humana or UnitedHealthcare.

2. Chronic Condition SNPs (C-SNP)

These are for people with specific long-term health conditions like:

- Diabetes

- Heart disease

- COPD (lung problems)

- End-stage kidney disease

C-SNPs offer special care programs to help manage your condition, including:

- Extra nurse check-ins

- Case management

- Tailored drug coverage

✅ Example: A senior on James Island with congestive heart failure might benefit from a C-SNP that includes their cardiologist in-network.

3. Institutional SNPs (I-SNP)

These plans are for people who live in:

- Nursing homes

- Assisted living facilities

- Or need nursing-level care at home

These plans are focused on comfort, consistent care, and support from a team that understands long-term care needs.

✅ Example: A resident at a skilled nursing facility in Mount Pleasant may qualify for an I-SNP that coordinates with the facility’s staff.

Who Can Enroll in a Special Needs Plan?

To qualify, you must:

- Be enrolled in Medicare Part A and B

- Live in a service area where the plan is offered.

- Meet the plan’s specific health or income qualifications.

Enrollment periods vary, but many people can enroll:

- When they first qualify for Medicare

- During the Annual Enrollment Period (Oct 15 – Dec 7)

- During a Special Enrollment Period if their health or income changes

Charleston County’s Healthcare Facilities and Providers

Choosing the right Medicare plan isn’t just about cost—it’s also about ensuring you can keep seeing your doctors and using the hospitals you trust.

Luckily, Charleston County is home to some of the best hospitals and clinics in South Carolina.

However, not every Medicare plan works with every provider.

That’s why it’s crucial to pick a plan that includes your preferred doctors and medical centers.

Top Hospitals in Charleston County

Here are some of the significant healthcare facilities that serve seniors across Charleston County:

🏥 MUSC Health University Medical Center

Located in downtown Charleston, MUSC is the state’s top teaching hospital and offers advanced care in:

- Cancer treatment

- Heart and vascular care

- Neurology

- Surgery

✅ Example: If you need a heart specialist at MUSC, ensure your Medicare Advantage plan includes MUSC in its network.

🏥 Roper Hospital

Just a few blocks from MUSC, Roper offers:

- Emergency care

- Orthopedic services

- Outpatient procedures

- Senior-focused wellness programs

✅ Example: A Medicare plan that doesn’t work with Roper St. Francis Healthcare could cost you extra if you get treatment there.

🏥 Trident Medical Center

Located in North Charleston, Trident offers:

- Stroke care

- Heart and vascular care

- Robotic surgery

- Rehabilitation services

🏥 East Cooper Medical Center

Found in Mount Pleasant, East Cooper is known for:

- Orthopedics and joint care

- Women’s health services

- Emergency services

- Outpatient surgery

Notable Clinics and Specialty Providers

Charleston County also has many independent clinics, urgent care centers, and specialty offices, including:

- Palmetto Primary Care Physicians – an extensive network of local doctors

- Roper St. Francis Physician Partners – specialists in cardiology, neurology, and more

- Lowcountry Women’s Specialists

- Coastal Pediatrics and Family Medicine for family coverage

✅ Example: If you regularly visit a urologist or diabetes specialist in West Ashley, you want a Medicare plan that keeps those visits affordable.

Make Sure Your Plan Works with Your Doctors

One of seniors’ biggest mistakes is picking a Medicare plan that doesn’t include their favorite doctor or hospital. This can lead to:

- High out-of-network costs

- Having to change doctors

- Denied claims or surprise bills

Don’t let that happen to you.

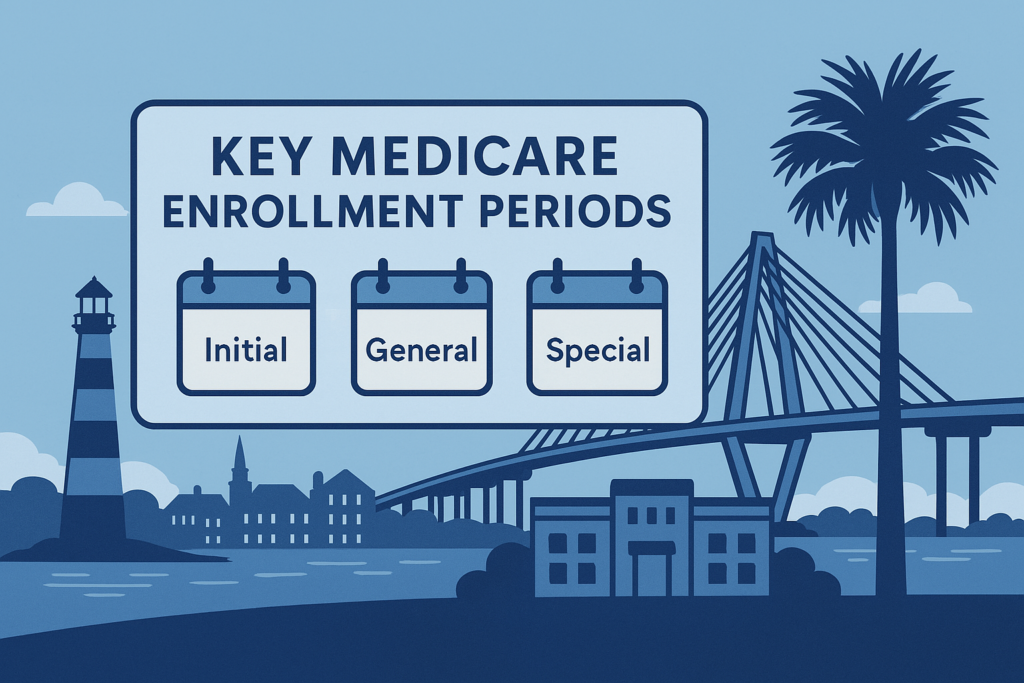

Enrollment Periods and Deadlines

When it comes to Medicare, timing matters.

Choosing the right plan is essential, but enrolling at the right time is just as important.

If you miss a deadline, you might have to wait months to get coverage, or even pay a penalty.

Here’s what you need to know about when to sign up.

Key Medicare Enrollment Periods

📅 Initial Enrollment Period (IEP)

This is your first chance to sign up for Medicare.

- It starts 3 months before your 65th birthday, includes your birthday month, and ends 3 months after.

- During this time, you can enroll in Parts A and B and choose a Medicare Advantage or Medigap plan.

✅ Example: If you turn 65 in July, your IEP runs from April to October.

📅 Annual Election Period (AEP)

This happens every year from October 15 to December 7.

- You can switch from Original Medicare to Medicare Advantage.

- Change from one Advantage plan to another

- Join, drop, or switch Part D (drug) plans.

Changes you make take effect January 1 of the following year.

✅ Example: A senior in Johns Island with a Part D plan can switch to a Medicare Advantage plan during AEP if they find one with better benefits.

📅 Special Enrollment Periods (SEPs)

These special situations allow you to change your Medicare plan outside the regular times.

You may qualify for an SEP if:

- You move out of your plan’s service area

- You lose other coverage (like job insurance or Medicaid)

- You qualify for a Special Needs Plan (SNP)

- You were affected by a natural disaster (like a hurricane)

✅ Example: If a senior moves from Columbia to Charleston, they get an SEP to pick a new local plan.

What Happens If You Miss a Deadline?

If you miss your Initial Enrollment Period or AEP:

- You might have to wait months to enroll

- You could get hit with late enrollment penalties that last a lifetime

- You might be stuck in a plan that doesn’t meet your needs

Avoiding Common Medicare Pitfalls

Medicare can be confusing, especially with all the plans, rules, and fine print.

Many Charleston County seniors make simple mistakes that cost them money or limit their healthcare choices.

Here’s how to avoid the most common Medicare pitfalls—and how Palmetto Mutual can help you stay one step ahead.

1. Not Understanding Network Restrictions

Many Medicare Advantage plans have a network of doctors and hospitals.

If you go outside that network, you might:

- Pay more out of pocket

- Get denied coverage

- Have to switch doctors.

✅ Example: A plan may not cover MUSC or East Cooper Medical Center visits unless those hospitals are in the network.

💡 If you love your current doctor or specialist, always make sure they’re included in the plan you choose.

2. Ignoring Coverage Gaps

Original Medicare (Parts A and B) doesn’t cover everything. You could still be responsible for:

- Hospital deductibles

- 20% of outpatient costs (with no limit)

- Prescription drugs

- Dental, vision, or hearing care

✅ Example: A Charleston senior with only Original Medicare who needs eye surgery could face a big out-of-pocket bill unless they have a Medigap plan or Medicare Advantage with extra coverage.

3. Missing Important Deadlines = Penalties

As mentioned earlier, missing your enrollment period can lead to late penalties that stick with you forever.

- Part B penalty: 10% added to your premium for every 12 months you delay

- Part D penalty: Added to your monthly drug plan cost

✅ Example: If someone in Mount Pleasant waits two years to sign up for Part B, they’ll pay 20% more—every month—for the rest of their life.

4. Choosing the Wrong Plan Without Help

Many seniors use Medicare.gov and try to do it all alone. But these tools can be confusing and overwhelming, especially with:

- Complex charts

- Long drug lists

- Fine-print costs

- Complicated plan rules

That’s why Charleston seniors often end up in plans that:

- Don’t cover their prescriptions

- Don’t include their doctor

- Charge too much in copays

The Palmetto Mutual Difference

When it comes to Medicare, it’s not just about picking a plan—it’s about choosing someone you can trust to guide you. That’s where Palmetto Mutual shines.

We’re not a call center. We’re not a national website that doesn’t know your zip code.

We’re your local Medicare partner, right here in Charleston County, and we’re proud to serve the seniors in our community.

Personalized Consultations and Support

At Palmetto Mutual, you’ll never feel like a number. We take time to:

- Learn about your doctors, your prescriptions, and your budget

- Explain all of your options in simple, easy-to-understand language

- Help you compare plans and pick what’s truly best for you

- Handle the enrollment paperwork so you don’t have to worry

✅ Example: Whether you live in Downtown Charleston, Goose Creek, Mount Pleasant, or Johns Island, we’ll meet you where you are—by phone or face-to-face.

Local Expertise That Makes a Big Difference

Charleston County is unique. Not every Medicare plan includes MUSC or Roper Hospital.

Not every prescription plan covers your preferred North Charleston or West Ashley pharmacy.

We know the difference—because we live here too.

- We understand the local networks

- We track which plans perform best in your area

- We stay up to date on plan changes that could affect your care

What Our Clients Are Saying

⭐ “Dvir made Medicare simple. I was so overwhelmed until he explained everything clearly. I got a plan that covers my doctors and saved me money every month.”

— Mary T., Charleston, SC

⭐ “Dvir helped my husband and me find a great plan that works with our prescriptions. I wish we had called him sooner!”

— Tom and Linda B., Mount Pleasant, SC