What Is Medicare? A Simple Guide for Seniors (2025 Edition)

Medicare is a federal health insurance program for seniors 65 and older. It helps cover hospital stays, doctor visits, prescriptions, and more. You can choose Original Medicare or a Medicare Advantage plan from top insurers nationwide.

Confused About Medicare? You’re in the Right Place.

Medicare can feel confusing—but you’re not alone. 😊

With so many parts, plans, and deadlines, it’s easy to feel lost.

Seniors nationwide—from big cities like Charlotte, Houston, and Detroit to small towns in Ohio, Texas, and North Carolina—have the same questions.

Here’s the good news: you don’t have to figure it out by yourself.

We’ve helped thousands of seniors just like you understand how Medicare works and enroll in the plan that fits them best—without stress, pressure, or confusing sales talk.

This guide is your simple, step-by-step roadmap to Medicare in 2025.

We’ll walk you through everything you need to know in plain English.

You’ve got questions. We’ve got answers.

Let’s make Medicare make sense. 👍

What Is Medicare? (Full Breakdown for 2025)

If you’re turning 65 or helping a loved one figure things out, you’ve probably heard of Medicare.

But what exactly is it?

A Quick History: Why Medicare Was Created

In 1965, the U.S. government created Medicare to help seniors get the medical care they need.

Before that, many older Americans couldn’t afford doctor visits or hospital stays.

Medicare was designed to fix that—and it still helps millions today.

👉 Think of Medicare as health insurance from the government, made just for seniors and certain people with health needs.

✅ Who Can Get Medicare in 2025?

You qualify for Medicare if:

- You are 65 or older

- OR you’re under 65 with a disability and have received Social Security Disability Insurance (SSDI) for 24 months

- OR you have End-Stage Renal Disease (ESRD) or ALS (Lou Gehrig’s Disease)

📍 Example:

Linda in Phoenix, Arizona turns 65 this year.

She qualifies for Medicare starting the first day of the month she turns 65.

💵 Is Medicare Free?

Many people think Medicare is free, but that’s not the case.

Here’s a simple breakdown of the costs:

- Part A (Hospital Insurance):

Usually free if you worked and paid Medicare taxes for at least 10 years

→ If not, you may pay over $500/month in 2025 - Part B (Medical Insurance):

Everyone pays a monthly premium (about $185 a month in 2025, and more if your income is higher)

→ Plus, there’s a deductible and 20% coinsurance after that - Prescription Drug Plans (Part D) and Medicare Advantage Plans (Part C) also have monthly premiums, copays, and deductibles

📍 Example:

Tom in Charlotte, North Carolina gets free Part A, but he still pays for Part B each month, and a bit more for his drug plan.

🔄 Medicare vs Medicaid: What’s the Difference?

These two names sound alike, but they’re very different:

| Medicare | Medicaid |

|---|---|

| For people 65+ or with certain disabilities | For people with low income |

| Run by the federal government | Run by each state |

| You usually pay premiums and deductibles | Often no cost or very low cost |

📝 Tip: Some people qualify for both Medicare and Medicaid.

These are called “dual eligible” and may get extra help paying for coverage.

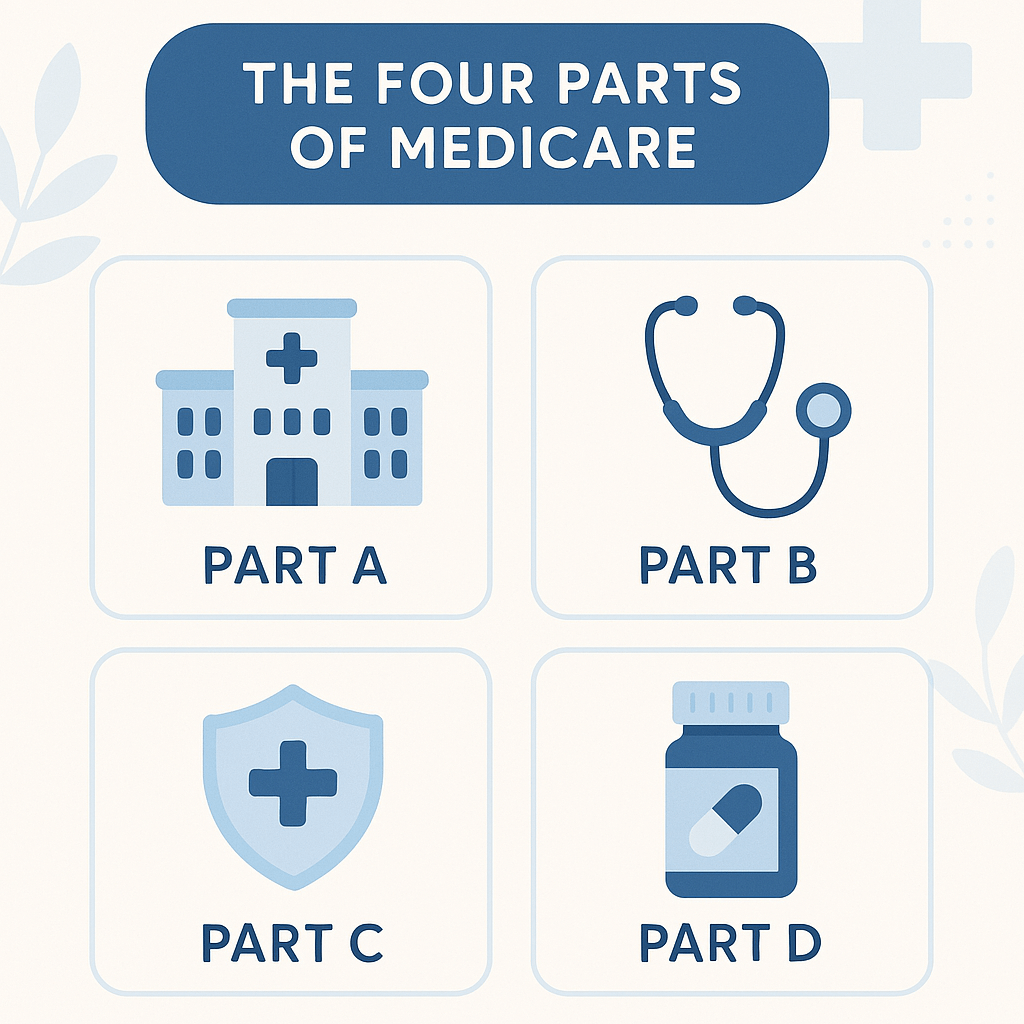

The Four Parts of Medicare — Explained Clearly

Medicare has four main parts.

They each cover different things, and it’s important to know how they work—especially in 2025.

Think of them like building blocks:

You can mix and match depending on your needs.

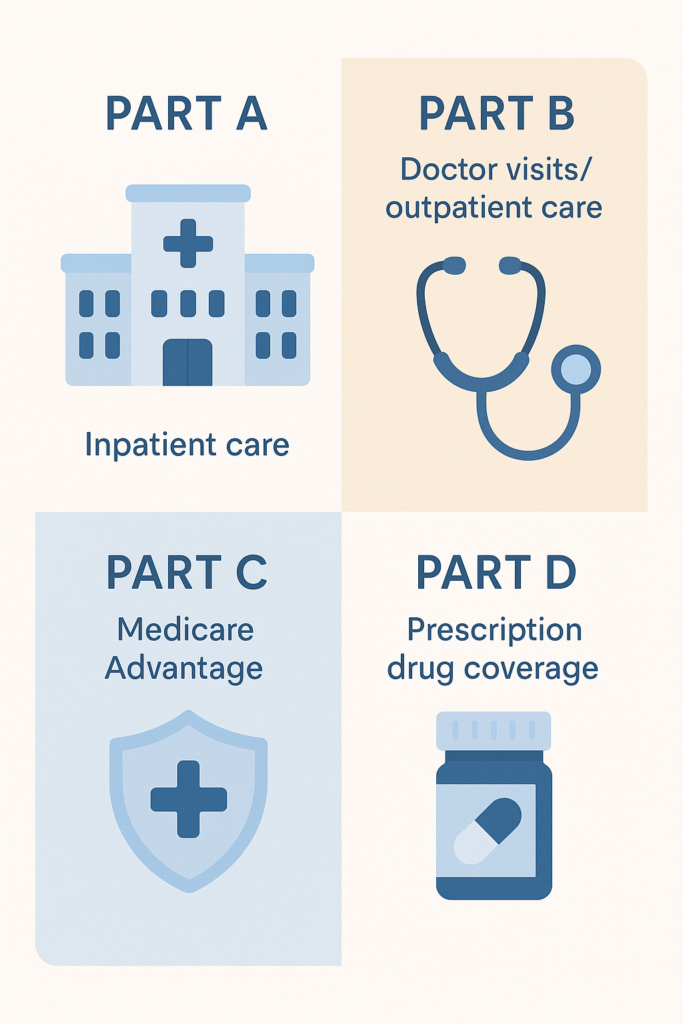

🏥 Part A: Hospital Insurance

Part A helps pay for:

- Inpatient hospital stays

- Skilled nursing facilities (after a hospital stay)

- Hospice care

- Some home health services

💲Most people pay $0 per month for Part A if they worked and paid Medicare taxes for at least 10 years.

📍 Example:

Barbara in Dallas, Texas worked full-time for over 30 years. She gets Part A with no monthly premium.

👨⚕️ Part B: Medical Insurance

Part B covers:

- Doctor visits

- Outpatient care (like lab tests, X-rays, and physical therapy)

- Preventive services (like screenings and vaccines)

💲Most people pay $185/month in 2025 for Part B.

However, if your income is higher, you may pay more.

That extra charge is called IRMAA (Income-Related Monthly Adjustment Amount).

📍 Example:

George and Mary in Naples, Florida are retired.

George pays the standard $185/month.

But Mary still earns a high income, so she pays a little more due to IRMAA.

🌟 Part C: Medicare Advantage

Part C is also known as Medicare Advantage.

These are plans offered by private insurance companies.

With Part C, you usually get:

- Part A + Part B

- Part D (drug coverage)

- Extra benefits like:

- Dental 🦷

- Vision 👓

- Hearing aids

- Over-the-counter (OTC) cards for groceries or pharmacy items 🛒

💲 Many plans have low or $0 monthly premiums, but you’ll still pay co-pays and possibly a Part B premium.

📍 Example:

Ruth in Atlanta, Georgia joined a Medicare Advantage plan that includes dental, vision, and a $100/month OTC card.

It even covers gym memberships!

💊 Part D: Prescription Drug Coverage

Part D helps pay for your medications.

You can get it two ways:

- As a standalone plan if you have Original Medicare

- Included in most Medicare Advantage plans

💲 Plans vary in cost depending on your prescriptions.

You may pay:

- A monthly premium

- A yearly deductible

- Copays or coinsurance at the pharmacy

📍 Example:

Sam in Seattle, Washington takes three prescriptions.

His Part D plan helps lower his costs, so he only pays $4, $10, and $20 per refill.

How to Enroll in Medicare

Enrolling in Medicare at the right time is very important—otherwise, you could face late penalties that stick with you for life. 😬

Don’t worry!

We’ll walk you through the main enrollment periods so you know when to sign up and how to avoid problems.

🎉 Initial Enrollment Period (IEP)

This is your first chance to enroll in Medicare.

- It starts 3 months before the month you turn 65

- Includes your birthday month

- Ends 3 months after your birthday month

- That’s 7 full months to sign up

📍 Example:

Sharon in Orlando, Florida turns 65 in June.

Her IEP runs from March 1 to September 30.

Tip: Sign up early to make sure your coverage starts on time.

⏳ General Enrollment Period (GEP)

If you miss your IEP, don’t panic.

You can still sign up during the GEP:

- Runs from January 1 to March 31 each year

- Coverage begins July 1

⚠️ Important: You may face late penalties if you wait until the GEP to sign up.

🛎️ Special Enrollment Periods (SEPs)

SEPs are for people who qualify to sign up outside the normal windows.

You may get an SEP if:

- You kept working past 65 and had employer health coverage

- You move to a new area

- You lose Medicaid or other coverage

- You had a natural disaster or emergency

📍 Example:

Mike in San Diego, California retires at 68.

Since he had employer coverage, he qualifies for a Special Enrollment Period with no penalty.

🚫 How to Avoid Late Penalties

Penalties can last for life, so enrolling at the right time is essential.

Here’s how to stay safe:

✅ Sign up for Part B during your IEP unless you have other creditable coverage

✅ Sign up for Part D (drug coverage) on time—even if you don’t take medications right now

✅ Don’t delay unless you’re still working and have group insurance

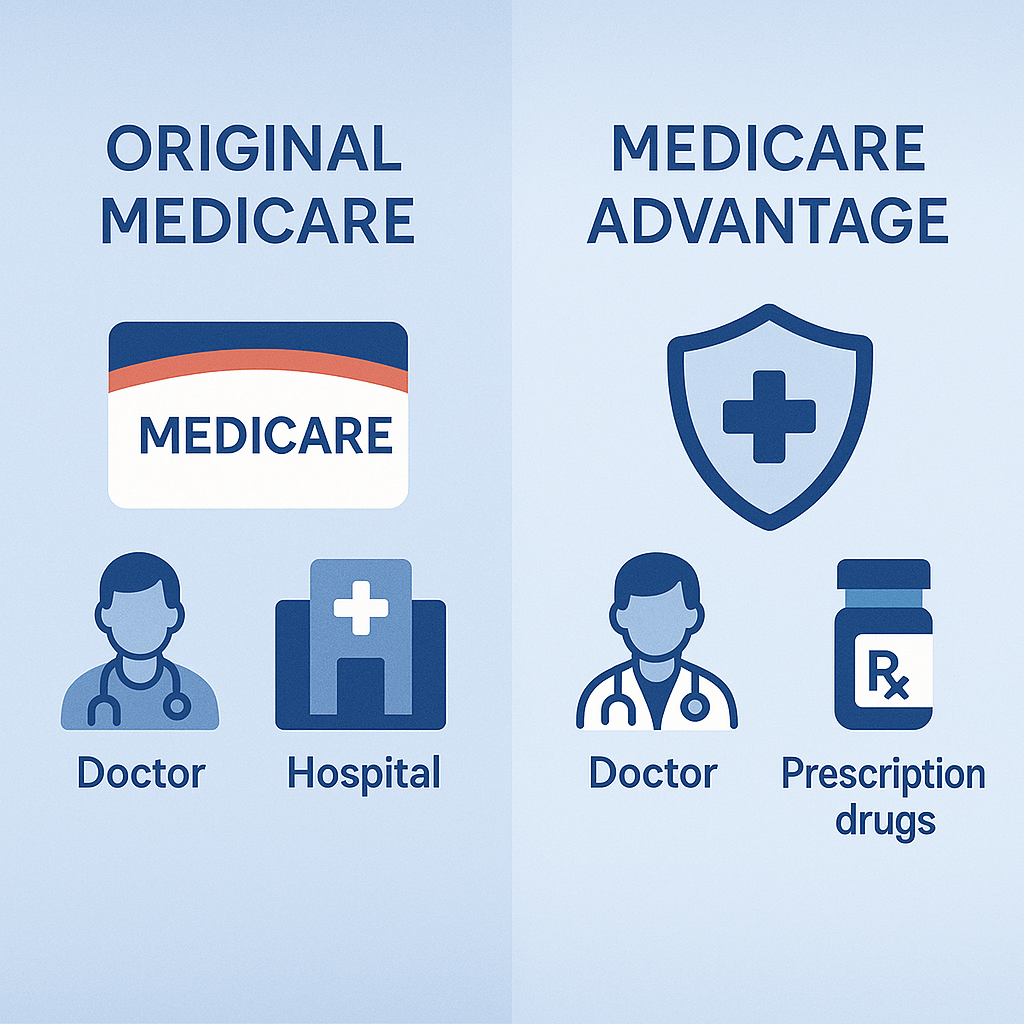

What Are Your Coverage Options?

Once you’re enrolled in Medicare, you’ll need to decide how you want to get your coverage.

There are two main ways to do it—and each has its pros and cons.

Let’s break them down so you can pick the one that works best for your health and your wallet. 💰

✅ Option 1: Original Medicare + Medigap + Part D

This option includes:

- Original Medicare (Parts A & B) – from the government

- A Medigap plan fills in the “gaps” like copays and deductibles

- A Part D drug plan – helps cover your prescriptions

🔹 What’s good about it?

- Freedom to see any doctor or hospital that takes Medicare—nationwide

- No referrals needed to see specialists

- More predictable out-of-pocket costs

- Great for people who travel or live in multiple states like Florida in winter and Michigan in summer

📍 Example:

Janet lives in Tampa, Florida during the winter and Cleveland, Ohio in the summer.

She chooses Original Medicare with Medigap so she can see any doctor, no matter where she is.

🔹 What to know:

- You’ll pay monthly premiums for Medigap and Part D

- Medigap doesn’t include dental, vision, or hearing—you’ll need separate coverage for that

🌟 Option 2: Medicare Advantage (Part C)

This is a private insurance plan that combines everything into one:

- Part A + Part B

- Usually includes Part D

- Often includes extra benefits like:

- Dental 🦷

- Vision 👓

- Hearing aids

- Over-the-counter (OTC) cards 🛒

- Gym memberships 🏋️

🔹 What’s good about it?

- Low or $0 monthly premiums in many areas

- Extra perks not covered by Original Medicare

- Great for people who want all-in-one convenience

📍 Example:

Frank in San Antonio, Texas is on a fixed income.

He chose a Medicare Advantage plan with $0 premium, free dental cleanings, and a $75 monthly grocery card.

🔹 What to know:

- Most plans use HMO or PPO networks

- You may need to see doctors in-network and get referrals to see specialists

- Costs vary based on how often you use healthcare services

🆚 Quick Comparison

| Feature | Original Medicare + Medigap | Medicare Advantage (Part C) |

|---|---|---|

| See any doctor? | ✅ Yes, anywhere in the U.S. | 🚫 Only in-network (most plans) |

| Monthly premiums | 💰 Higher | 💲 Lower or $0 |

| Predictable costs | ✅ Yes (with Medigap) | ❓ Depends on plan usage |

| Extra benefits (dental, vision) | ❌ No | ✅ Yes |

| Drug coverage | 🧾 Add Part D separately | ✅ Usually included |

🏆 Top-Rated Medicare Insurance Companies in 2025

Choosing the right Medicare insurance company can greatly affect your coverage, cost, and benefits.

Some companies offer better value based on where you live and your specific health needs.

Let’s take a look at some of the top-rated Medicare providers in 2025 and what makes each one unique.

🌐 Nationwide Leaders

These companies are available across most of the U.S. and are trusted by millions of seniors:

The largest Medicare Advantage provider, known for broad networks and strong customer service

Offers great value with dental, vision, and OTC cards in many markets

Known for competitive premiums, solid drug coverage, and wide availability

A top choice for Medigap (Supplement) plans with stable rates and good service

Offers both Medicare Advantage and Medigap options, with perks like meal delivery after hospital stays

📍 Example:

Dorothy in Columbus, Ohio picked an Aetna Medicare Advantage plan with dental and hearing aid coverage for under $20/month.

🏥 Regional & Specialty Plans

These companies aren’t everywhere, but they shine in select markets:

- Blue Cross Blue Shield (BCBS) – Offers Medicare plans under different names in each state (like Anthem, Highmark, or BCBS of Florida)

- Devoted Health – Growing fast in states like Florida, Texas, and Arizona with high customer satisfaction

- Wellcare – Offers low-cost plans with generous extras in places like California, Georgia, and New York

📍 Example:

Luis in Miami, Florida chose Devoted Health for its $0 plan that includes dental, $100/month grocery card, and a 24/7 nurse hotline.

🧩 One Size Doesn’t Fit All

Not every company is the best choice for every person.

Here’s what to consider:

- Location: Some plans are only available in certain states or counties

- Health Needs: Some companies offer better diabetes, heart, or chronic care benefits

- Doctors: Check if your favorite doctor is in-network

- Budget: Look at the total cost, not just the monthly premium

The Nation’s Best Hospitals Accepting Medicare

When you need serious medical care, you want to know you’re going to the best hospital possible.

The good news?

Medicare is accepted at nearly every major hospital in the country.

Let’s take a look at some of America’s top hospitals that accept Original Medicare and many Medicare Advantage plans too.

⭐ Top Hospitals That Accept Medicare

These world-class hospitals are leaders in surgery, cancer care, heart treatment, and more:

- Mayo Clinic – Locations in Minnesota, Arizona, and Florida

- Cleveland Clinic – World-famous care in Ohio, with satellite centers nationwide

- Johns Hopkins Hospital – Top-ranked for decades, located in Baltimore, Maryland

- Cedars-Sinai – Leading research and care in Los Angeles, California

- Massachusetts General Hospital (Mass General) – A teaching hospital for Harvard, in Boston, MA

📍 Example:

Evelyn from Scottsdale, Arizona used her Original Medicare to get expert heart care at Mayo Clinic in Phoenix—with no referrals or pre-approvals needed.

🏥 Does Medicare Cover These Hospitals?

- ✅ Original Medicare is accepted at almost every hospital in the U.S., including all the top-ranked ones listed above

- ✅ Many Medicare Advantage (Part C) plans also cover these hospitals, but you may need to:

- Check if the hospital is in-network

- Get a referral or pre-authorization before treatment

- Travel to another county or state if the plan’s network is limited

📍 Example:

Robert in Pasadena, California has a Medicare Advantage PPO plan.

He was able to use it at Cedars-Sinai, because it was in-network.

📝 Tips for Getting Top-Tier Care with Medicare

- Choose Original Medicare with a Medigap plan if you want the freedom to go anywhere without network rules.

- If you prefer Medicare Advantage, be sure to ask if your hospital and specialists are covered before enrolling.

- Need help? Palmetto Mutual can double-check your doctors and hospitals to make sure you’re fully covered.

What Does Medicare Cost?

Medicare helps pay for your healthcare, but it’s not free.

Let’s break down the costs so you know what to expect in 2025.

We’ll keep it simple and easy to understand—because no one likes surprises when it comes to bills! 💸

🏥 Part A: Hospital Insurance

- ✅ Usually free if you (or your spouse) worked and paid Medicare taxes for 10 years

- ❌ If not, the premium could be over $500/month in 2025

📍 Example:

Judy in Nashville, Tennessee worked most of her life.

She gets Part A for free—no monthly premium.

👩⚕️ Part B: Medical Insurance

- 💵 Most people pay $185/month in 2025

- 📈 If your income is higher, you may pay more due to IRMAA (Income-Related Monthly Adjustment Amount)

📝 IRMAA Example:

Your Part B premium could go up if you earn more than $103,000 (single) or $206,000 (married).

📍 Example:

Helen in Boca Raton, Florida has a high retirement income.

She pays around $230/month for Part B with IRMAA added.

💊 Part D: Prescription Drug Coverage

- 💲 Monthly premiums vary depending on the plan you choose

- Some plans have deductibles and copays

- Higher income? You might also pay IRMAA for Part D

📍 Example:

Ron in Boise, Idaho pays $14/month for his Part D plan.

His friend Mark, who takes more meds, pays $38/month with a lower copay at the pharmacy.

🌟 Medicare Advantage (Part C)

- Many plans offer $0 monthly premiums

- You still pay your Part B premium

- Some plans include extras like dental, vision, and a grocery card

🛑 Keep in mind:

- You may pay copays when you go to the doctor

- Plans have a yearly maximum out-of-pocket limit, which protects you from big bills

- In 2025, most plans cap your costs at around $8,850 or less for in-network care

📍 Example:

Tina in Charlotte, North Carolina has a $0 premium Medicare Advantage plan with an $80 copay for specialists and a $5,900 yearly max out-of-pocket limit.

🛡️ Medigap (Medicare Supplement Insurance)

- Helps cover what Original Medicare doesn’t—like deductibles and 20% coinsurance

- Premiums depend on:

- Your age

- Gender

- ZIP code

- The plan letter you choose (Plan G, Plan N, etc.)

📍 Example:

Earl in Denver, Colorado, pays $122/month for a Plan G Medigap policy and has almost no other out-of-pocket costs during the year.

💬 Final Tip:

Don’t pick a plan based on just the monthly premium.

Look at the whole picture—copays, deductibles, drug costs, and doctor networks.

How to Protect Yourself From Medicare Scams

Medicare scams are on the rise, and unfortunately, seniors are the #1 target. 😞

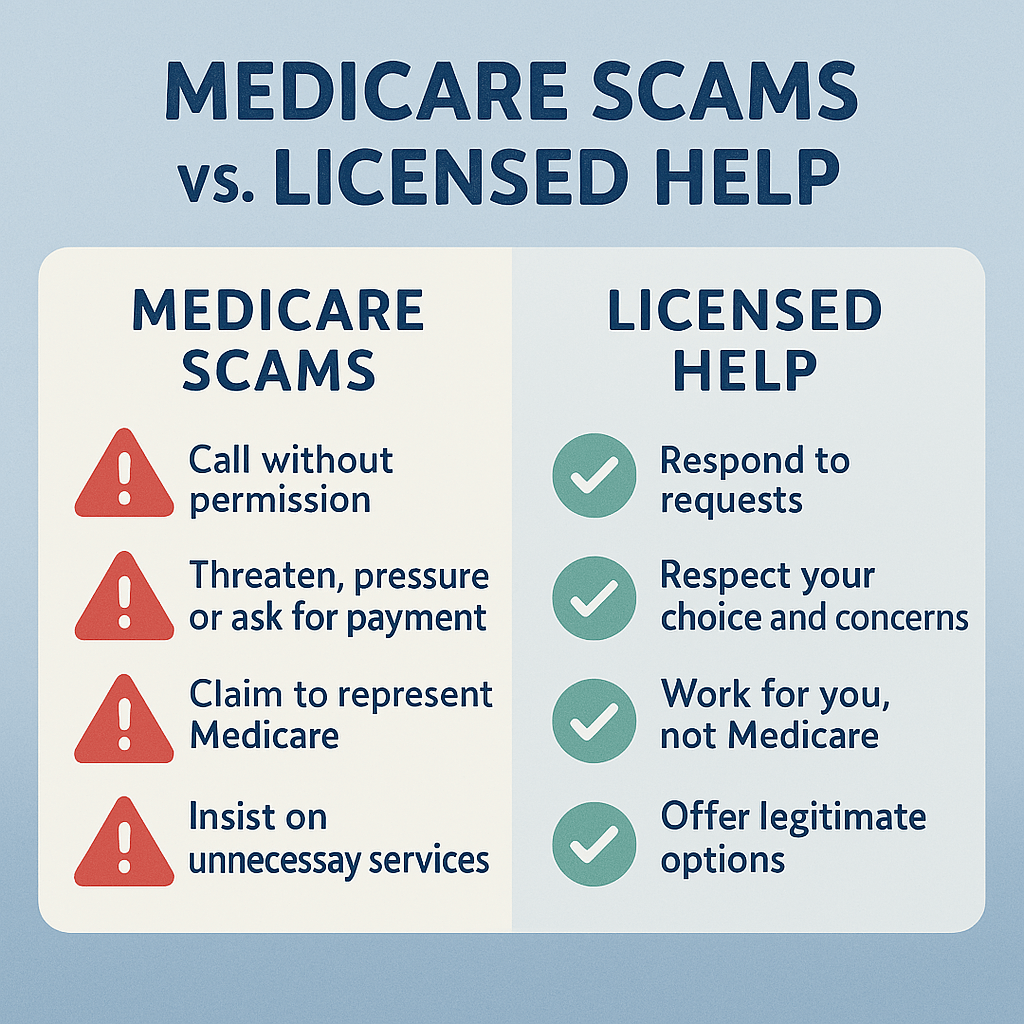

🚨 Red Flags: Common Medicare Scams

Watch out for these warning signs:

- Unsolicited phone calls claiming they’re “from Medicare”

- Mailers that look official but ask for personal info

- People offering free gifts or money in exchange for your Medicare number

- Pressure to switch plans immediately or “before a deadline” that doesn’t exist

🛑 Important:

Medicare will NEVER call you to sell plans or ask for your Medicare number. If someone does, it’s likely a scam.

📍 Example:

Jean in Las Vegas, Nevada got a call offering a “new Medicare card with extra benefits”—all she had to do was give her Medicare number.

Luckily, she hung up and reported it!

😵 Why Medicare.gov Can Be Confusing

Medicare’s official website is full of good information—but it’s not easy to use, especially if:

- You’re not comfortable using computers

- You don’t know which plan type to search for

- You’re comparing dozens of options that all sound the same

It’s easy to get overwhelmed—and that confusion is what scammers count on.

🤝 Why a Licensed Expert Is the Safest Choice

A trusted agent can help you:

- Understand your options clearly

- Avoid plans that don’t match your needs

- Make sure your doctors and prescriptions are covered

- Apply securely and correctly with no guesswork

📍 Example:

Ray in Greenville, South Carolina almost signed up for a plan that didn’t cover his heart medications.

A local agent from Palmetto Mutual caught the issue and helped him find a better plan.

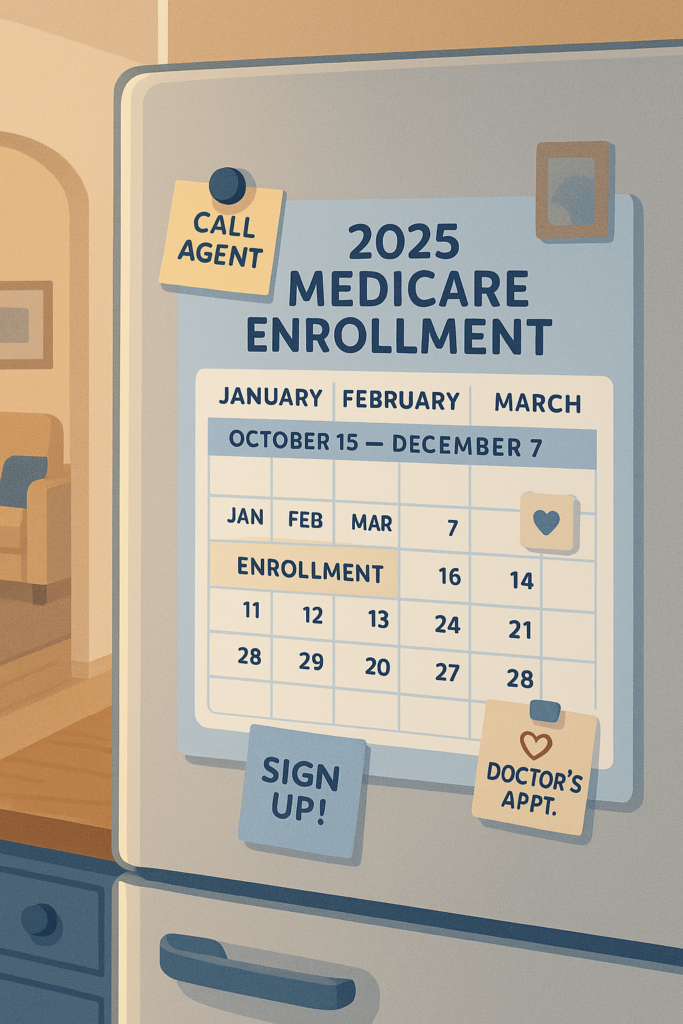

Annual Medicare Calendar (When You Can Change Plans)

Medicare isn’t a one-and-done deal—you can review and change your coverage every year. But you have to do it during the right time. ⏰

Here’s a quick look at the 2025 Medicare calendar to know when you can make changes and how to avoid missing deadlines.

🔁 January 1 – March 31

Medicare Advantage Open Enrollment Period (MA-OEP)

If you’re already on a Medicare Advantage plan, this is your chance to:

- Switch to a different Medicare Advantage plan, OR

- Go back to Original Medicare and add a Part D plan

🛑 You can only make one change during this time.

📍 Example:

Paul in Austin, Texas, found out in January that his plan dropped his doctor.

In February, he switched to a new Medicare Advantage plan that kept his provider.

🍂 October 15 – December 7

Annual Enrollment Period (AEP)

This is the main time of year to make changes.

You can:

- Switch from Original Medicare to Medicare Advantage

- Switch from Medicare Advantage back to Original Medicare

- Change your Part D drug plan

- Join a plan for the first time

Changes made during AEP take effect on January 1 of the following year.

📍 Example:

Eleanor in Phoenix, Arizona compares plans every October to make sure she’s getting the best deal on her prescriptions for the new year.

📌 Special Enrollment Periods (SEPs)

You may qualify for a Special Enrollment Period if you:

- Move to a new address

- Lose other health coverage

- Qualify for Medicaid or Extra Help

- Have a natural disaster in your area

- Leave or join a skilled nursing facility

📍 Example:

Carlos in Charlotte, North Carolina, moved to a new ZIP code and got a 2-month SEP to pick a new Medicare Advantage plan in his area.

🛡️ Don’t Miss a Deadline

Missing an enrollment period can mean:

- Higher out-of-pocket costs

- Delayed coverage

- Or even penalties that last for life

🧠 Frequently Asked Questions (FAQ)

We get a lot of the same questions from folks all over the country—from Raleigh, North Carolina to San Diego, California—and we’re here to give you straight, easy answers.

If you’ve got questions about Medicare in 2025, chances are you’ll find the answers here!

❓Can I change my Medicare plan anytime?

🛑 No, you can’t change your Medicare plan anytime.

You can only switch plans during certain times of the year:

- October 15–December 7 (Annual Enrollment Period)

- January 1–March 31 (if you’re already in a Medicare Advantage plan)

- During a Special Enrollment Period (SEP) if you qualify (like moving or losing coverage)

- Medicare Supplement Plans (Medigap) can be changed throughout the year.

❓Is Medicare free?

❌ Medicare is not free.

Here’s what you usually pay:

- Part A: Usually free if you worked 10+ years

- Part B: About $185/month in 2025 (more if your income is higher)

- Part D & Medicare Advantage: Prices vary depending on the plan

You may also have deductibles, copays, and coinsurance.

❓How do I compare Medicare plans in my ZIP code?

To compare plans in your area, you need to:

- Know your ZIP code

- Look at which doctors, drugs, and benefits are covered

- Compare costs like monthly premiums and copays

- Understand the difference between Medicare Advantage and Medigap

🔎 Palmetto Mutual can run a local Medicare comparison for your ZIP code—at no cost.

We make it easy.

❓What happens if I miss my Medicare enrollment period?

⏳ Missing your enrollment window can lead to:

- Delays in coverage

- Lifetime late penalties

- Fewer plan choices

But if you missed it due to a qualifying event, you may still qualify for a Special Enrollment Period.

❓Should I choose Medicare Advantage or Medigap?

It depends on your needs and lifestyle:

🟦 Medicare Advantage may be better if you want:

- $0 premium plans

- Extra benefits like dental, vision, or OTC cards

- Local network care

🟨 Medigap + Original Medicare may be better if you want:

- Freedom to see any doctor

- Fewer out-of-pocket costs

- More predictable expenses

Why Palmetto Mutual Is the Trusted Medicare Expert You Deserve

You don’t need to figure out Medicare alone.

With so many parts, plans, and deadlines, it’s easy to feel overwhelmed—but that’s exactly why Palmetto Mutual exists. 😊

We help seniors make smart Medicare choices—without spam calls, pushy salespeople, or confusing websites.

Here’s what makes us different:

- ✅ We’re licensed brokers working with multiple top-rated carriers

- ✅ We listen first, then guide you toward the plan that fits your life

- ✅ We explain everything in simple terms, step by step

- ✅ We’re by your side before, during, and after enrollment

Whether you want help comparing plans in your ZIP code or just have a few questions, we’re here for you.